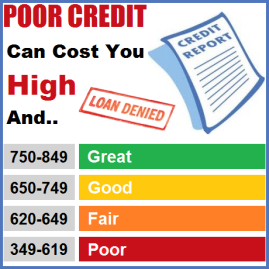

A credit score of 700 gets you the best lending rate from the banks. But if you’ve missed some bill payments—or worse, filed for bankruptcy—you’ll have to work strategically to build your score back up. These tips will help you do it as quickly as possible.

KNOW YOUR LIMITS

Try to keep your credit-card balance well below the limit. If your cards are almost maxed out, it suggests you’re overextended and more likely to make late or missed payments. The higher your balance, the more impact it has on your credit score.

CHECK YOUR SCORES—BOTH OF THEM Anyone contemplating a bank loan should check their credit score six months to a year in advance to ensure there are no surprises or errors. Just keep in mind that Canada has two major credit-reporting agencies: Equifax and TransUnion. This can lead to significant differences in scores, as these firms only synchronize their scores every two months.

STEER CLEAR OF RETAIL CARDS The next time you’re tempted to sign up for a Brick or Sears card, remember that each separate credit card application inquiry results in a ‘hard check’ that lowers your credit score by seven points. If your score is around 700 and you’re house hunting, signing up for a couple of retail cards could mean the difference between getting the best mortgage lending rate or a much higher ‘B-lender’ rate.

JUST PAY IT Paying off your debts quickly is one of the most effective ways to raise your score. If you’ve missed some bills and your score hovers around 600, it will likely take a year to boost it up 100 points to an optimal 700—assuming you’ve made good on all arrears. A score of 500, indicating bankruptcy, will take two to three years to repair.

HISTORY COUNTS If you have no track record of borrowing money and paying it back, chances are you’ve got a low credit score because lenders have nothing to gauge your credit worthiness against. So if you have a credit card but never use it, you can increase your score by making occasional purchases and paying them off. And think twice about closing an old account you don’t use anymore, as having a 10-year-old account actually helps you demonstrate a credit history.