Have you been approved for a mortgage and waiting for the completion date to come? Well, it is not smooth sailing until AFTER the solicitor has registered the new mortgage. Be sure to avoid these 10 things below or your approval status can risk being reversed!

1. Don’t change employers or job positions

Any career changes can affect qualifying for a mortgage. Banks like to see a long tenure with your employer as it shows stability. When applying for a mortgage, it is not the time to become self employed!

2. Don’t apply for any other loans

This will drastically affect how much you qualify for and also jeopardize your credit rating. Save the new car shopping until after your mortgage funds.

3. Don’t decide to furnish your new home or renovations on credit before the completion date of your mortgage

This, as well, will affect how much you qualify for. Even if you are already approved for a mortgage, a bank or mortgage insurance company can, and in many cases do, run a new credit report before completion to confirm your financial status and debts have not changed.

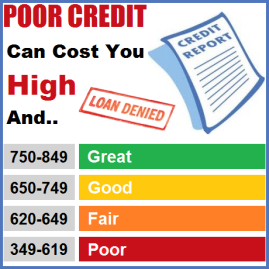

4. Do not go over limit or miss any re-payments on your credit cards or line of credits

This will affect your credit score, and the bank will be concerned with the ability to be responsible with credit. Showing the ability to be responsible with credit and re-payment is critical for a mortgage approval

5. Don’t deposit “mattress” money into your bank account

Banks require a three-month history of all down payment being used when purchasing a property. Any deposits outside of your employment or pension income, will need to be verified with a paper trail. If you sell a vehicle, keep a bill of sale, if you receive an income tax credit, you will be expected to provide the proof. Any unexplained deposits into your banking will be questioned.

6. Don’t co-sign for someone else’s loan

Although you may want to do someone else a favour, this debt will be 100% your responsibility when you go to apply for a mortgage. Even as a co-signor you are just as a responsible for the loan, and since it shows up on your credit report, it is a liability on your application, and therefore lowering your qualifying amount.

7. Don’t try to beef up your application, tell it how it is!

Be honest on your mortgage application, your mortgage broker is trying to assist you so it is critical the information is accurate. Income details, properties owned, debts, assets and your financial past. IF you have been through a foreclosure, bankruptcy, consumer proposal, please disclose this info right away.

8. Don’t close out existing credit cards

Although this sounds like something a bank would favour, an application with less debt available to use, however credit scores actually increase the longer a card is open and in good standing. If you lower the level of your available credit, your debt to credit ratio could increase and lowering the credit score. Having the unused available credit, and cards open for a long duration with good re-payment is GOOD!

9. Don’t Marry someone with poor credit (or at lease be prepared for the consequences that may come from it)

So you’re getting married, have you had the financial talk yet? Your partner’s credit can affect your ability to get approved for a mortgage. If there are unexpected financial history issues with your partner’s credit, make sure to have a discussion with your mortgage broker before you start shopping for a new home.

10. Don’t forget to get a pre-approval!

With all the changes in mortgage qualifying, assuming you would be approved is a HUGE mistake. There could also be unknown changes to your credit report, mortgage product or rate changes, all which influence how much you qualify for. Thinking a pre-approval from several months ago or longer is valid now, would also be a mistake.

What prevents many potential homeowners from buying a home is the lack of a down payment.

What prevents many potential homeowners from buying a home is the lack of a down payment. Ever wonder how your mortgage rate is determined? What factors make it jump from percentage to percentage? We are getting down to the nitty gritty today and giving you the facts on what impacts mortgage rates.

Ever wonder how your mortgage rate is determined? What factors make it jump from percentage to percentage? We are getting down to the nitty gritty today and giving you the facts on what impacts mortgage rates.

Some of you are going to ask what is a ARM and VRM? These two acronyms are mortgage speak for adjustable rate mortgage and variable rate mortgage. These two mortgage products are both based on the prime rate of interest, in most cases this is 2.70% at the bank. TD chose to be higher by .15% at 2.85%, so it isn’t controlled by the Bank of Canada. It is an individual financial institution policy.

Some of you are going to ask what is a ARM and VRM? These two acronyms are mortgage speak for adjustable rate mortgage and variable rate mortgage. These two mortgage products are both based on the prime rate of interest, in most cases this is 2.70% at the bank. TD chose to be higher by .15% at 2.85%, so it isn’t controlled by the Bank of Canada. It is an individual financial institution policy.

Self Employed mortgage tips:

Self Employed mortgage tips: